2 BHK flat in Bommasandra Bangalore

48 L

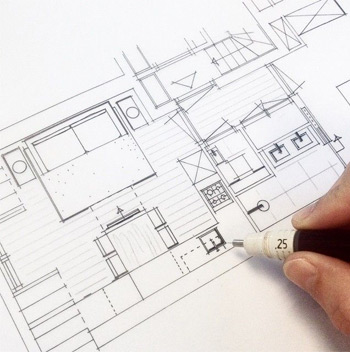

2 Bed Room | 2 Bathrooms | 1 Balconies | unfurnished

Carpet area : 949 Sq. Ft.

Built up Area: 711 Sq. Ft.

Parking : Yes

Floor : Higher of 12 floors

Nearby Places : SFS Academy (CBSE), KLAY Preschool and DayCare - Electronic City, Phase 1, and Treamis World School.

Bank Finance : Available

Construction Status : Ready to move

Property ID : 3FL722

Facilities

Gym, Garden, Sports Facility, Swimming Pool, Intercom, Clubhouse, Community Hall.Description

Having a total area of 949 sq. ft. Flat/ Apartment for sale in Bommasandra, Bangalore starting from Rs. 48 Lakh .

Get a bank loan on this property, instead of paying the full amount at the time of purchase you can pay it in EMI.

The locality Bommasandra is one of the most growing locality in Bangalore surrounded by many ongoing/ developed areas nearby. Currently, Bangalore city is one of the most emerging cities in Karnataka having many ongoing developments to will improve the infrastructure and future of the city.

The nearby localities at flat are SFS Academy (CBSE), KLAY Preschool and DayCare - Electronic City, Phase 1, and Treamis World School. .

Investment in the flat in Bommasandra, Bangalore may give a higher return than bank deposits and if you are planning flat for your dream home Bommasandra, Bangalore is one of the best choices.

There are many schools, colleges, hospitals, shopping destinations and transportation facilities nearby this locality and continuously growing.

Stamp Duty & Registration charges in Karnataka

When someone buys a property Stamp duty and property registration tax will be applied to the property transaction. Stamp duty is a tax levied on property transactions.

The property transaction must be registered once the stamp duty is paid. Stamp duty and registration charges in Karnataka may vary based on the property type, transaction value, and other factors.

The registration charges are usually consistent and are based on the transaction value or the guidance value of the property, whichever is higher.

In Karnataka the stamp duty for men and women are same the stamp duty for Men & Women is 5% and registration charges are 1%.

Suppose you are buying a property of 40 Lakh then the stamp duty at the rate of 5% will be Rs.200000 and the registration charges at the rate of 1% will be Rs.40000. After the registration charges and stamp duty your property will be approx Rs.4240000.

It is important to know about the property registration charges, stamp duty and other charges while registering the property. The charges given above may vary in some cases, for accurate information about stamp duty, registration charges and other charges in Karnataka on property please visit the government's official website of Karnataka https://kaverionline.karnataka.gov.in/