Plot plus Construction Loan in Kozhikode

Plot plus construction loan is meant to cover both the cost of buying the land and building a new house on it. These loans are likewise secured by the value of the land, and the borrower normally needs to have enough equity in the land to borrow against it. The loan will cover the price of the materials and labour required to build the home, unlike a plot loan.

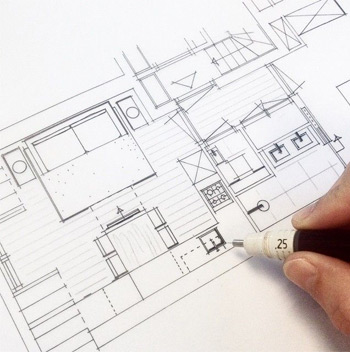

Normally, borrowers are required to submit comprehensive construction blueprints for the home as well as pertinent details such as a timeframe, cost estimates, and other details. The borrower of these loans could further need to put down some money or offer more security.

Home Construction Loan Interest Rates in Kozhikode

| Banks | Interest Rate (p.a) |

| SBI | 6.95% p.a. |

| HDFC Bank | 7.35% p.a. |

| PNB Housing Finance | 9.25% p.a. |

| Canara Bank | 6.90% p.a. |

Plot Loan Interest Rate in Kozhikode

| Banks | Interest Rate (p.a) |

| HDFC Bank | 8.60% p.a. onwards |

| SBI | 8.75% p.a. onwards |

| PNB | 8.55% p.a. onwards |

| Axis Bank | 8.60% p.a. onwards |

| Canara Bank | 8.55% p.a. onwards |

Documents Required to apply for Plot plus Construction Loans in Kozhikode

- Identity proof

- Address proof

- Income proof

- current utility bill

- Duly filled application form

- Bank statement for the last six months

- Approved building plan

- Property tax receipt

- No dues certificate from the builder

- original records proving who owns the property

Eligibility Criteria for Plot plus Construction Loan in Kozhikode

The following is a list of the requirements that must be met to qualify for a plot loan.

- Must be a resident of Kozhikode

- Applicant must be employed either salaried or self-employed

- Should be aged between 18 and 65

- The applicant must have the necessary documents to show the source of the down payment for the loan.

- The Borrower must have a good credit score.

Loans for plot and plot plus construction are a fantastic option to pay for the property and build a new house. With a plot and plot plus construction loan, you can buy the property, construct the house, and pay back the loan all at once. You now have a clear understanding of the terms plot and plot plus construction loan after reading the aforementioned article. If you meet the requirements, your dream home is almost within reach. Just a few more steps will bring your goal to fruition.

What people are asking about Plot plus Construction Loan?

Does a loan for constructing a plot provide tax benefits?

A: You are eligible for the following tax benefits once construction is finished. The benefit of taxation under Section 80C: According to Section 80C of the Income Tax Act, you may deduct up to Rs. 150,000 annually from the principal repayment portion of your plot loan.

Do we need to build a house if we take a plot loan?

A: You can only buy "residential plots" using loans, so if you do, you'll have to build a house there within two to three years of purchasing the plot. You can't merely purchase a plot and choose not to build a house on it.

Which bank offers the best rates on a plot loan?

A: The bank with the lowest interest rate, the greatest customer service, and the longest term will be the best for a plot loan. You must review the list of banks and their interest rates to take advantage of the finest deal.

What are the most affordable banks for plot loans in India?

A: HDFC, SBI, ICICI and PNB are some of the most affordable banks for plot loans in India.

What is the longest land loan you can get?

A: Land loans are basically for short term with tenure of 2 to 5 years.

What is a good credit score?

A: Good credit score is 720 or higher.